When someone searches ” The Coin Republic Cardano ADA prediction”, they may be referring to the price expectations and analysis of ADA coins published by The Coin Republic, as well as the company’s interpretation in context. When the Coin Republic This article unpacks what The Coin Republic has speculated, compares it to other forecasts, looks at Cardano ‘s due diligence, identifies key levels of demand and supply in ADA, explores possible catalysts and risks, and eventually gives its own well – reasoned opinion. Cardano BlockChain ‘s own ADA token continues with an academic approach, but some are more high – profile offshoot than others in recent years.

Think of it as textbook knowledge paired with strict fidelity to its theories, which is Cardano. With a line of upgrades in the off-season (Hydra, Mithril, Shang, etc.) and a design review that passed muster at peer review stage- if ADA goes up, many who stand to gain from these sorts of projects will lose out. But price predictions in cryptoasset are notoriously (and often dramatically) wrong, and ADA, as we shall see, is no exception to this rule. So, here we’ll explore what’s possible with that caution in mind.

What The Coin Republic Says

The Coin Republic, as The coin republic Cardano ADA prediction crypto news and analysis outlet, has published several pieces related to Cardano price prediction and outlook. A few points of importance picked up by the authors: In a recent article The Coin Republic speculated that the price of Cardano would range around $0.90 or see a short-term drop to $0.84, then up no further. Elsewhere it discusses the possibility of ADA rising to $10 during this cycle, and cites bullish signals, strong fundamentals for its network and planet-wide upgrades as proof. The Coin Republic’s piece “Why And How Can Cardano (ADA) Reach $10? ”also points out that in order for such an increase in price to occur CARDANO would have to be at least 1300% higher than today, and This is something which The Coin Republic calls “very possible” given Cardano’s capabilities. In their Cardano Price Prediction section, The Coin Republic puts the average price of ADA in 2025 at around $0.90. So, the message is that The Coin Republic is suggesting less profit in the short term (e.g., near $0.90) and more ambitious goals for a strong bull market. They are saying that ADA has room to rise, but also that there may need be consolidation periods or favorable market conditions before it can do so. With that in mind as a certain mark from which to evaluate other predictions and arguments we will go on.

Read Also: Winning the War on Weeds: How Weed Control Services Can Transform Your Landscape

Broader Forecasts & Market Sentiment: What Others The Coin Republic Cardano ADA prediction

To provide context for The Coin Republic’s predictions, “The coin republic Cardano ADA prediction“, let’s take a look at what other analysts and publications have to say about Cardano’s price in 2025 or beyond.

Technical / Quantitative Forecasts

- CoinCodex: Projects that ADA will rise by about 30% and reach ~$1.19 in October 2025.

- Changelly: Their 2025 forecast ranges from a minimum of $0.826 to maximum $0.926; their average is around $1.06.

- LiteFinance / Analysts’ Opinions: we anticipate that ADA might rise to as high as $0.95 in 2025 assuming the ecosystem develops robustly. Moving beyond basic ideas for businesses outgrow their current situation!

- InvestingHaven: Offers a range from ‘when the price hits this point, it stops going up’ ($0.824 Fibonacci resistance) all the way down to ‘clearing that level’: minimum $0.66 and maximum $1.88; average $1.21 (conditionally based on certain technical resistance and support).

- Benzinga: Forecasts ADA’s average 2025 price will be around $0.945, with the highest estimates pushing up $1.376.

- TokenMetrics / TokenMetrics blog: In a bullish market, ADA might exceed $3.38 at some point (depending on broader market advances).

- Traders Union: Their table gives a median prediction for 2025 around $1.00 but notes that because of the many factors involved it is unlikely to climb to much higher levels in this timeframe.

Sentiment, On-Chain, and Fundamental Observations

- Upgrading Cardano’s ecosystem (Plutus V3, Midnight, Hydra scaling, governance improvements) is seen as heralding wider acceptance Often cited as catalysts for broader adoption.

- Cardano Foundation’s roadmap (2026 plan) sets out six priorities, including deepening DeFi, Web3 integration and scaling tokenized real world assets This shows an earnest attempt to make ADA a bigger utility than it has been.

- Some analysts suggest that banking tie-ups, ETF approvals and institutional flows could act as catalysts for ADA to break much higher E.g. $1.327 could then act as resistance for ADA should those elements align.

- Downside risks are also pointed out. If DeFi TVL on Cardano shrinks, or if ADA violates tech support levels, it could pressure downward.

- More than one forecast warns that ADA is unlikely to hit high (eg $10) without a strong bulls’ market-there’s a lot of dependency in the bull case on whether or not “If the market surges”.

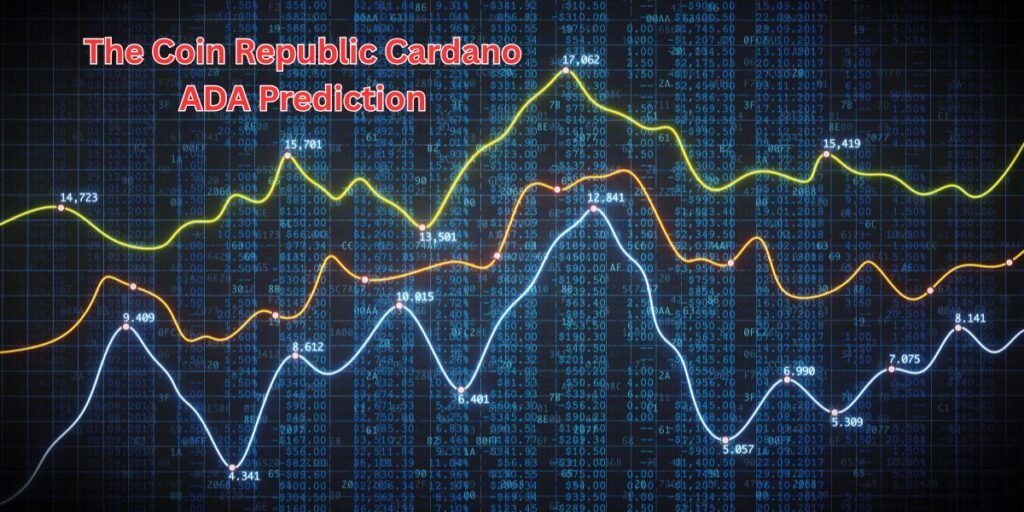

Cardano ADA Prediction: Key Technical Levels, Chart Patterns & Market Structure

Therefore, any bold forecast has to be based on your actual knowledge. The coin republic Cardano ADA prediction Levels, Patterns, and Observations for Till Recently From historical charts and analysis:

- Support & Resistance Zones

- Support: The $0.82-$0.85 area is frequently cited as crucial support (retraces often come right back up).

- Near-term resistance: To some this is a pivot zone at $0.90 (either of consolidation first or of a break and continuation).

- Higher resistance targets: $1.20, $1.30, $1.50 or more are often mentioned in bullish scenarios.

- Trend and Patterns

- Rising Band / Rising Trend:: Some analysis shows ADA to be comfortably within an upward channel (lower lows) (currently) with resistance around $0.94-$0.95.

- Ground-Wedge / Breakout Formations: Some analysts think that ADA may be emerging from a ground-wedge (bullish reversal pattern) and that things are now wide open.

- Triangle / Break after consolidation: Recently, there’s been a little upward breach of various long-term consolidation phases.

- Other Indicators

- Sentiment / CoinCodex Fear & Greed Index: CoinCodex gives a neutral sentiment (fear & greed index ~49).

- MAs, Volume, Momentum Rising volume on breaks, bullish momentum and crosses up 50/200 will be essential to confirm continuation of the trend. (Exact numbers vary across different platforms.)

These tell you that now the coin republic cardano ADA prediction is at a crossroads: either it consolidates at this level and fails to break out, or it gets past the resistance zones and aims its sights higher.

Fundamental Drivers & Catalysts That Could Move According To The coin Republic Cardano ADA Prediction

Price moves do not occur in a vacuum. Below are the fundamental levers and catalysts that could help (or hurt) ADA’s trajectory.

Positive Drivers

- Major Upgrades & Roadmap Execution

- Cardano’s development roadmap is aggressive Hydra (scaling), Mithril (light clients), Midnight (privacy/layer), Plutus V3 governance decentralization, etc. If all of these items are rolled off relatively smoothly, the speed adoption would be substantially accelerated. The 2026 roadmap update focuses on DeFi, Web3, tokenized realvision minutes (RWA), and expanding governance. Those cooperative measures quite possibly will bear fruit for the farmer: stable and nourishing fruit.

- Cardano’s development roadmap is aggressive Hydra (scaling), Mithril (light clients), Midnight (privacy/layer), Plutus V3 governance decentralization, etc. If all of these items are rolled off relatively smoothly, the speed adoption would be substantially accelerated. The 2026 roadmap update focuses on DeFi, Web3, tokenized realvision minutes (RWA), and expanding governance. Those cooperative measures quite possibly will bear fruit for the farmer: stable and nourishing fruit.

- Institutional & Regulatory Tailwinds

- Approval of cryptocurrencies exchange-traded funds (ETFs): If ADA were included in crypto ETFs And there was capital investment of institutional investors as a result, some reports indicate that bank integration alone might raise market value by as much as 45% to levelss upcoming prices $1.3272 among others.

- With larger adoption of cryptocurrencies and positional regulatory clarity, something like ADA may benefit from “legalization”. In that sense relatively speaking This is for the ordinary man just trying to get ahead, Friday is a day on which those hills can be seen ahead again (if not exactly topped).

- Growing Use Cases / Ecosystem Activity

- Expansion of DeFi, NFTs, smart contracts, stablecoins, DApps, and real-world assets on the Cardano chain will bring demand for ADA ( transaction fees, staking, collateral ). Even More projects build off Cardano and it may start to see some network effects, such as greater demand, greater liquidity more than ever before.

- Expansion of DeFi, NFTs, smart contracts, stablecoins, DApps, and real-world assets on the Cardano chain will bring demand for ADA ( transaction fees, staking, collateral ). Even More projects build off Cardano and it may start to see some network effects, such as greater demand, greater liquidity more than ever before.

- Whale Accumulation & On-Chain Signals

- Some data indicates that the “whale” (large ADA holders) is rackn up incremental purchases Which would appear to be seen as one of the supports for prices; not a bad thing at all. If on-chain metrics are top-level, such as declining supply on exchange, increasing stake rates or growth in active addresses then these also receive a positive reading.

Risks & Headwinds

- Regulatory Uncertainty

- Laws or umidifiable rules might ruin investor appetite such as adverse regulations, bans and taxation of profits for cryptocurrency. This uncertainty makes price fluctuations unpredictable – which is something companies are relying on in order to make money. Crypto regulation has yet to take shape on a global basis but the consequences may dampen investor demand soon enough if these kind of goverance decisions continue.

- Laws or umidifiable rules might ruin investor appetite such as adverse regulations, bans and taxation of profits for cryptocurrency. This uncertainty makes price fluctuations unpredictable – which is something companies are relying on in order to make money. Crypto regulation has yet to take shape on a global basis but the consequences may dampen investor demand soon enough if these kind of goverance decisions continue.

- Technical Execution Risks

- For instance: Delayed launches, hard-to-use features and subpar service might disappoint users. The other consequence is that if promised technological improvements do not come up to expectations or are delayed in implementation then markets may well lay siege upon ADA until it gets slaughtered.

- For instance: Delayed launches, hard-to-use features and subpar service might disappoint users. The other consequence is that if promised technological improvements do not come up to expectations or are delayed in implementation then markets may well lay siege upon ADA until it gets slaughtered.

- Competition from Other Blockchains

- Solana and other newer chains with dramatic performance gains (e.g., Avalanche) have the energy from better marketing to seize developer mindshare. As a lower-energy coin, Cardano needs to remain competitive in speed and cost, as well as firm enough that it fails forego network-wide support from future consortiums.

- Market Conditions / Macro Environment

- As we know, crypto markets are highly correlated with macro factors like interest rates, common sentiment on inflation news and announcements. Even institutional money when it goes in and out affects prices. A broader downturn could drag ADA down despite good fundamentals long-term outlook for some non-technical reason.

- Technical Breakdowns

- If the key support fails, this could put ADA under further downside pressure and may bring it back into lower ranges again.

For example, extremely high targets (e.g. $10) reflect speculative optimism rather than grounded fundamentals. It is better to weigh such forecasts carefully unless they are backed up by a catalyst of some type.

Read Also: Avoid QY-45Y3-Q8W32 Model: Why It’s a Risk Not Worth Taking

Reconciling The Coin Republic’s View with the Broader Landscape

Let’s see monetarilly practical viewpoints from others world, while also examining that point of view together with our own based in fundamentals and technicals.

- Near-Term (~2025)

For recent years up until 2023, the Coin Republic’s overall forecast of $0.90–1 appears in line with some other recent third-party predictions (e.g. CoinCodex, Benzinga, Changelly). This is a fairly conservative to moderately bullish base case and not very different from the current support/resistance lines. - Upside Scenarios (Bull Market / Cycle Peak)

The Coin Republic quotes such stronger forecasts as ADA getting to $10 from a number of sources (for instance Dan Gambardello). However, for many market participants those are rather pie-in-the-sky targets that depend on general market rallies, institution money flows and getting all bases on Cardano’s roadmap checked off. They should be considered “upside supplements” to point-of-principle cases, not mid-line results. - Risk-Aware or Conservative Paths

Some are setting lower awards for ADA,e.g. Itsupport zone fails and prices dance around $0.66UTE it is hard to see how this would not be a down-grade if market conditions sour.

Thus The Coin Republic’s mix of the “moderate base → bullish stretch” best fits this over-all market trend, although I must stress that hitting $10 in 2025 seems too optimistic and would involve near-perfect conditions.

Our Reasoned ADA Forecast (2025 & Beyond)

Here’s how ADA looks to Panews: Having swallowed the point of view of The Coin Republic, technicals, fundamentals, and other forecasts, we give our balanced review/forecast for 2019.

2025 Forecast

- Base Case / Likely Range

Most Likely Range: Between $0.80 and $1.30 is where ADA is most likely to trade by 2025. Monthly average levels iron out around $0.90-1.10 respectively. - Upside Scenario

Of course, if things go exactly as planned, with facing blockages not in our thinking then we might be looking somewhere nearer $1.50 to $2.00 in ADA’s price by 2025. However, much beyond that may not happen. - Downside / Bearish Scenario

ADA may revisit the $0.70 price-point, or lower, if it breaks the support region around $0.85. In very harsh crypto markets, some loss of momentum or shock from the regulators might be enough to let the price fall below $0.60. But that necessarily means a very strong trigger will provide for this stage of negativity.

Read Also: 10.24.1.53 – What It Is, How It Works, and Why You Should Care

Cardano (ADA) Price Prediction for the Next 5 Years

The long-term price outlook for Cardano’s (ADA) remains cautiously optimistic, driven by steady ecosystem growth, consistent upgrades, and our commitment to scalability and sustainability. Over the next five years, Cardano’s price is expected to gradually climb as adoption increases and new projects launch on its blockchain. While short-term volatility will likely persist, ADA’s fundamentals — low transaction costs, active development, and expanding DeFi and NFT ecosystems — position it well for a slow and hoarding appreciation. If major upgrades like Hydra, Mithril, and Midnight performs as expected, ADA could see higher valuation, especially during broader cryptocurrency bull cycles. However, external factors such as market sentiment, regulation, and competition from other Layer-1 chains will continue to influence its trajectory.

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Key Factors Influencing Price |

| 2025 | $0.80 | $1.05 | $1.50 | Hydra scaling adoption, ETF speculation, overall crypto market trend |

| 2026 | $1.10 | $1.60 | $2.10 | Broader DeFi growth, institutional inflow, governance upgrades |

| 2027 | $1.50 | $2.40 | $3.20 | Increased developer adoption, RWA tokenization on Cardano |

| 2028 | $2.00 | $3.10 | $4.50 | Mainstream Web3 integration, regulatory clarity |

| 2029 | $2.80 | $4.20 | $6.00 | Mass adoption, global partnerships, matured ecosystem stability |

Key Milestones & Watchpoints for ADA Observers

If you’re tracking ADA (or writing forecasts in the future), here are key events and indicator thresholds to monitor:

- Upgrade Releases & Dates: Success (or failure) in rolling out Hydra, Midnight, Mithril, Plutus V3 and other roadmap items will decisively influence sentiment.

- Regulatory / Institutional Actions: News around ADA being included in ETFs, uptake by institutions, or favourable regulation could all provide upward boost.

- On-Chain Metrics: Active addresses, transaction volume, staking rates, supply on exchanges vs. wallets, whale accumulation trends.

- Trading Volume & Liquidity: Breakouts accompanied by heavy volume tend to prove more sustainable. Low volume breakouts frequently go into reversal mode.

- Support / Resistance Breakout Levels: Key zones to watch are the $0.90 / $0.94 / $1.00 / $1.20 areas. In addition, critical will be whether the support band (~$0.82-$0.85) holds.

- Macro / Crypto Market Trends: Bitcoin and Ethereum performance, crypto capital flows, macro sentiment (interest rate policy, regulation) will influence ADA.

- Competitive Landscape Shifts: Emergence of new L1/L2 protocols, migration of developers, or adoption of cross-chain bridges may affect Cardano’s competitiveness.

Read Also: All Here Job com | Henof.com Gaming

Conclusion: The Coin Republic Prediction – Reasonable, if Optimistic

The Coin Republic’s ADA forecast: The average CARDANO (ADA) price for 2025 (in the running range from $0.90 up to $10) comes within spectrum of what analysts are predicting. Their conservative forecast jibes with many. However their aggressive ” $10 ” scenario is very much a hope all share but few expect to see realized. Here is our assessment: The most likely scenario by 2025 will be that ADA is traded in a range of $0.80 to $1.30, with the occasional push if catalysts line up.Reaching $2+ is feasible over the medium to long term (2026–2030) given consistent adoption, sound fundamentals and a supportive market. Goals like $10 for 2025 are wildly optimistic targets that would require an almost perfect alignment of factors: technical, adoption, regulatory and market sentiment.Crypto markets are volatile and uncertain. Analysis (whether provided by The Coin Republic or not) ought to be treated as ‘what if’ scenarios rather than absolute truths. Always manage risk, diversify and keep in mind the changing fundamentals. But for watchers and believers of Cardano, there may well be a genuine potential situation ahead – provided that the team lives up to expectations, and the general market is cooperative.